The Benefits of Using a Mortgage Calculator

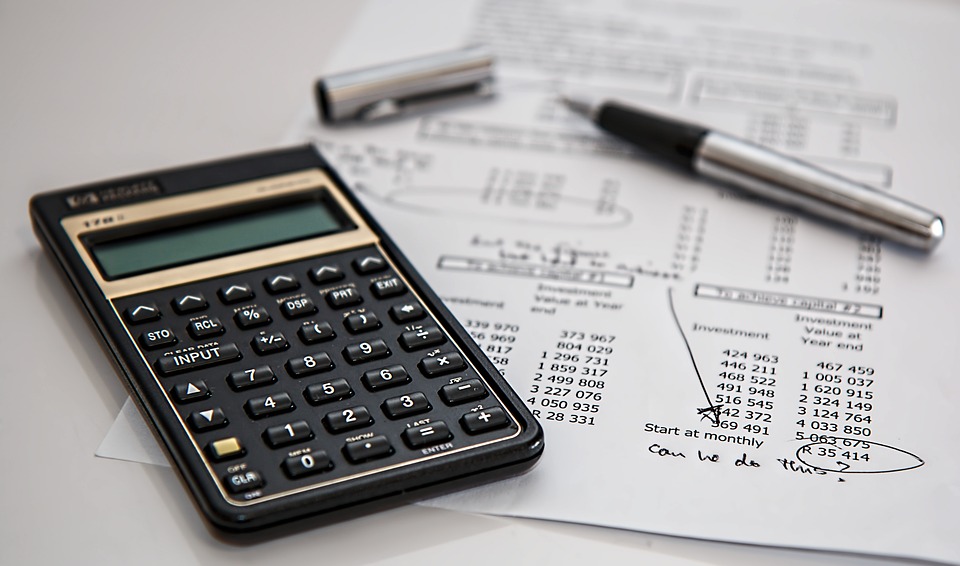

As someone who is in the market for a new home, I understand the importance of crunching numbers to find the perfect mortgage. When it comes to making one of the most significant financial decisions of your life, using a mortgage calculator can be a game-changer. In this blog post, I will explore the various benefits of using a mortgage calculator and how it can help you find the perfect home.

1. Determine Your Budget

One of the first benefits of using a mortgage calculator is that it helps you determine your budget. By entering information such as your income, expenses, and down payment amount, you can get an accurate estimate of how much you can afford to spend on a home. This can save you time and energy by only looking at properties that are within your budget.

2. Compare Different Loan Options

Another benefit of using a mortgage calculator is that it allows you to compare different loan options. You can input various interest rates, loan terms, and down payment amounts to see how they will affect your monthly payments. This can help you find the best loan option that fits your financial situation.

3. Plan for the Future

Using a mortgage calculator can also help you plan for the future. By inputting different scenarios, such as paying extra towards your principal each month or refinancing after a few years, you can see how these decisions will impact your overall loan. This can help you make informed choices that will benefit you in the long run.

4. Avoid Surprises

Finally, using a mortgage calculator can help you avoid surprises. By getting a clear picture of your monthly payments, including principal, interest, taxes, and insurance, you can budget accordingly and avoid any financial strain down the road. This can provide peace of mind knowing exactly what to expect each month.

Exploring Different Mortgage Calculators

Now that we’ve covered the benefits of using a mortgage calculator, let’s explore different types of calculators that are available to help you find the perfect home:

1. Simple Mortgage Calculator

A simple mortgage calculator allows you to input basic information such as loan amount, interest rate, and loan term to get an estimate of your monthly payments. This is a great tool for getting a quick snapshot of what you can afford.

2. Advanced Mortgage Calculator

An advanced mortgage calculator offers more options for customization, such as including property taxes, homeowners insurance, and HOA fees in your monthly payments. This can give you a more accurate picture of the total cost of homeownership.

3. Refinance Calculator

If you’re considering refinancing your current mortgage, a refinance calculator can help you determine if it’s the right move for you. By inputting information about your current loan and potential refinance terms, you can see how much you could save in interest over time.

4. Rent vs. Buy Calculator

A rent vs. buy calculator can help you decide whether it makes more financial sense to rent or buy a home. By comparing the costs of renting versus buying, including factors such as home appreciation and tax deductions, you can make an informed decision about your housing options.

Conclusion

Using a mortgage calculator is a valuable tool that can help you find the perfect home while staying within your budget. By determining your budget, comparing loan options, planning for the future, and avoiding surprises, you can make informed decisions that will benefit you in the long run.

FAQs

- Can I use a mortgage calculator for free?

- How accurate are mortgage calculators?

- Can a mortgage calculator help me save money?

Yes, most mortgage calculators are available for free on financial websites and lender websites.

While mortgage calculators can provide a good estimate of your monthly payments, it’s essential to consult with a lender to get a more accurate picture of your specific situation.

Yes, using a mortgage calculator can help you save money by finding the best loan option for your financial situation and planning for the future.